Retirement. Wha?

I'm 26 years old.

I'm 26 years old.If statistical averages are correct, then I'm not even halfway through my projected lifespan. Why would I worry about retirement? Better yet, why should you worry about retirement?

Read this.

It's not some gloom-and-doom prediction about the retirement age for my generation. And it isn't a preachy list of things you should be doing now to plan for then. It's just a financial "Dear, Abby" article from a couple in Colorado who want to know if they've done enough planning and saving to retire at 55.

The reason I'm posting this is to highlight just how much money this couple has had to save in order to retire. If you read and do the math, you'll note that as of age 43, they've already stashed $592,000 away strictly for retirement. And remember, there are still 12 years worth of saving on top of that before they reach 55.

You're looking at a 2-person family with no children who are able to put the maximum amount into their retirement savings: $28,000 into IRA + $12,000 into mutual funds per year. The couple makes $130,000 combined per year in income - which is nothing to sneeze at. But that works out to $65,000 a piece in yearly salary.

This family has packed away a huge amount. They've diligently prepared for retirement in a way that most of us won't come close to matching. And they're worried about being able to retire at 55?

If these two haven't done it right, then who has? I mean, how much would they need to have invested so as to not worry about retirement??

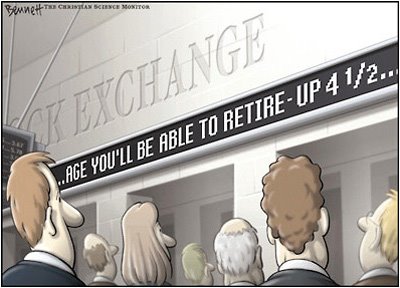

The point here is that planning for retirement is a mammoth undertaking - even in the most ideal circumstances. If you start late, you are hosed. Everyone, regardless of income can start planning now.

Don't think you're too young to start saving. You aren't. Even if it's a small amount at first, start putting away money with every paycheck. Just get in the habit.

Read this and this and even this.

You don't want to work until the day you die*.

*If you do want to work until the day you die, disregard this.

0 Comments:

Post a Comment

<< Home